new mexico solar tax credit 2019

8 rows New Mexico Sustainable Building Tax Credit SBTC Qualify for up to 650 per built sq. New Mexico has a lot of sunlight.

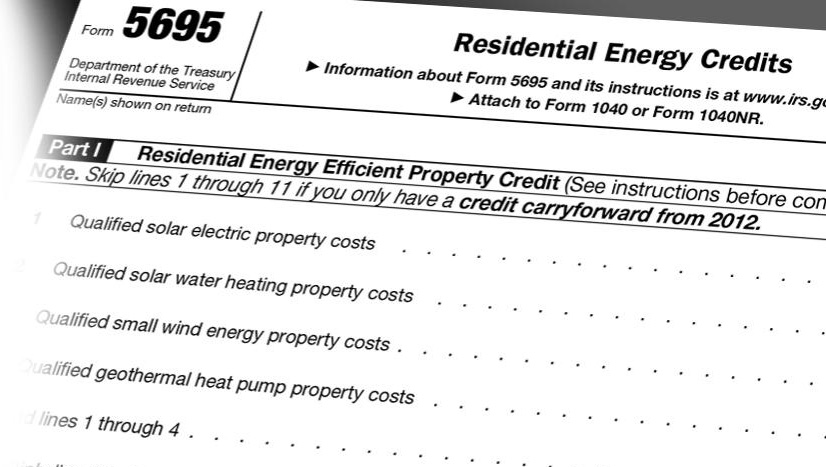

How To Claim The Solar Tax Credit Itc Irs Form 5695 Forme Solar

Under the state legislation signed Tuesday New Mexico will deliver one-time tax rebates of 250 for individuals who file taxes in New Mexico for 2021 or 500 for joint.

. The 10 percent tax credit toward the purchase of a solar system is available to New Mexico residents and business owners with a 6000 cap per taxpayer per year. Non-refundable credits can be used to reduce tax liability but if the tax due is reduced to 0 the balance of these credits is not refunded. Ft cap when you install a new home solar system.

Senate Bill 29 sponsored by Sen. If you buy and install a solar system in 2019 youll claim a tax credit of 30 but if you wait till 2020 the tax credit will have reduced to 26. New Mexico Energy.

New Mexico Solar Market Development Tax Credit. The price of solar installation has dropped drastically. New Mexico provides a 10 personal income tax credit up to 9000 for individuals sole proprietorship businesses and agricultural enterprises who purchase and install certified photovoltaic PV and solar thermal systems.

The current 30 solar tax credit will apply to any solar. Matthew McQueen D-50 would allow those who construct solar power facilities to apply for a tax credit from the State of New Mexico. This incentive can reduce your state tax payments by up to 6000 or 10 off your total solar energy expenses whichever is lower.

The New Mexico Solar Market Development Tax Credit or New Mexico Solar Tax Credit was passed by the 2020 New Mexico Legislature and signed by New Mexico Governor Michelle Lujan Grisham. When the previous credit expired solar jobs fell 25 percent across New Mexico. Any solar installations in your home or business will allow you to claim new mexico solar tax credits of as much as 10.

It is taken in the tax year that you complete your solar install. 10 Income Tax Credit. Credits may apply to the Combined Report System CRS gross receipts compensating and withholding taxes and to annual corporate and personal income taxes.

Personal income tax credits. This bill provides a 10 tax credit with a savings value up to 6000 for a solar energy systems. Alternative Energy Product Manufacturers Tax Credit.

Solar Market Development Tax Credit New Mexico provides a 10 personal income tax credit up to 9000 for residents and businesses non-corporate including agricultural enterprises who purchase and install certified photovoltaic PV and solar thermal systems. The federal solar tax credit. In 2020 New Mexico lawmakers passed a statewide solar tax credit called the New Solar Market Development Income Tax Credit.

NM State RE Tax Credits. It covers 10 of your installation costs up to a maximum of 6000. Claiming Business-Related Tax Credits for Individuals and Businesses or form PIT-CR Non-Refundable Tax Credit Schedule.

Since most average sized 6kW systems cost about 18000 you can expect a credit of about 1800. For example if you buy a huge solar installation that comes out to 80000 your tax credit will stop at the 6000 limit. New Mexico provides a 10 personal income tax credit up to 9000 for individuals sole proprietorship businesses or one that is required or allowed to elect to file taxes using IRS Form 1040 and agricultural enterprises who purchase and install certified photovoltaic PV and solar thermal systems.

The Solar Market Development Tax Credit provides a tax credit of 10 for small solar systems including on-grid and off-grid PV systems and solar thermal systems. Eligible systems include grid-tied commercial PV systems off-grid and grid. If your income is low enough that you dont owe income taxes then you wont qualify for the tax credit.

Fill Out the Binder of Required PDFs. So the ITC will be 26 in 2020 and 22 in 2021. For assistance see the New Solar Market Development Income Tax rule 3314 NMAC for personal income taxes or 3421 NMAC for corporate income taxes and other information available at the Clean Energy.

While the federal ITC is worth 26 percent of the cost of your installation the New Mexico solar tax credit caps out at 10 percent of the cost or 6000 whichever is less. These are the solar rebates and solar tax credits currently available in New Mexico according to the Database of State Incentives for Renewable Energy website. There is a 26 federal tax credit available and there is no state tax that is paid on solar Gross receipts tax.

Upload Application Please review the above list before you upload your documentation to make sure youve completed all forms required in the tax credit application package. You will then file for the tax credit with your tax return before April the following year using the Form 5695. Each year after it will decrease at a rate of 4 per year.

While the 30 Federal Tax Credit for solar is set to begin ramping down at the end of 2019 a new bill SB29 introduced into the 2019 legislative session would reintroduce the New Mexico Solar Tax Credit. For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit. The credit could be up to 10 percent of the purchase and installation costs not to exceed 6000.

New Mexicos previous solar tax credit system expired in 2016. An applicant claiming a state tax credit shall not claim a state tax credit pursuant to another law for costs related to the same solar energy system costs. In order to qualify your home needs to be certified sustainable by the US.

New Mexico Solar Tax Credits. In the middle of the American southwest nestled between Texas and Arizona the Land of Enchantment could be the next state to embrace solar energy if the State Legislature approves Senate Bill 518. PNM was granted approval to extend the Customer Solar REC Purchase Programs through the end of 2019.

Mimi Stewart D-17 and Rep. The Residential Solar Investment Tax Credit ITC for the total cost of solar installation goes until 2019 at 30. The tax credit applies to residential commercial and agricultural installations.

Schedule PIT-CR is used to claim non-refundable credits. General types of tax credits are. This area of the site summarizes New Mexicos business-related tax credits and the procedures for claiming them.

However the amount of your claim should not exceed 6000. The bill would create an income tax credit for 10 percent of solar installations costs at a home or business. New Mexico state solar tax credit.

This incentive is proposed to last until January 2029. Ft with a 2000 sq. Adding in all of those factors we will typically save you 10-15 on your current bill but it depends on how much your current bill is and which utility company you have.

Investment Tax Credit For Solar Power Solar Tax Credits Solar Power

Full Guide To Kansas City Residential Solar Panels Updated For 2021

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Pin On Solar Powered Businesses

How The Solar Tax Credit Makes Renewable Energy Affordable

The Ultimate 2020 Guide To California Solar Tax Credit And Incentives

Tax Credit Info Daylighting Systems Solar Powered Fans Solatube

New Mexico Solar Incentives Rebates And Tax Credits

Information On Solar Energy Federal Tax Credits Northern Arizona Wind Sun

The Ultimate 2020 Guide To California Solar Tax Credit And Incentives

Oil Companies Are Collapsing Due To Coronavirus But Wind And Solar Energy Keep Growing The New York Times

How To Calculate The Federal Solar Investment Tax Credit Duke Energy Sustainable Solutions

/cute-house-155419616-83d6059b201244e5830079c9802ccbb9.jpg)

Solar Incentives Everything You Need To Know

Federal Solar Tax Credit 2022 How It Works How Much It Saves

Solar Tax Credit Details H R Block

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

New Mexico State Solar Tax Credit Offers A Promising Addition To The Growing Industry Novogradac

Fact Vs Myth Can Solar Energy Really Power An Entire House 2021 Update Bluesel Home Solar